Practical Money Management for Young Minds

Smart Shopping Strategies for Avoiding Impulse Purchases

Impulse purchases can quickly derail your budget and leave you feeling regretful. Developing smart shopping strategies is crucial for financial well-being. These strategies involve proactive planning, recognizing triggers, and establishing clear financial goals. Understanding your spending patterns and identifying what motivates impulsive buys will empower you to make more conscious choices.

Effective budgeting is a cornerstone of smart shopping. A well-defined budget helps you visualize your income and expenses, allowing you to allocate funds strategically. By knowing where your money is going, you can identify areas where you might be overspending and make necessary adjustments to avoid impulse purchases.

Understanding Your Spending Habits

Taking the time to understand your spending habits is key to avoiding impulse buys. Note what triggers your impulsive spending, whether it's a specific advertisement, a special occasion, or simply a desire to treat yourself. Analyzing your spending patterns helps you anticipate potential triggers and develop coping mechanisms.

Creating a Realistic Budget

A realistic budget is vital for avoiding financial strain and impulse purchases. It should reflect your actual income and expenses, allowing for both essential needs and discretionary spending. This budget should also incorporate a buffer for unexpected expenses. Creating a plan for your money is empowering and allows for greater financial freedom.

A budget that's too restrictive can backfire, leading to feelings of deprivation and potentially more impulsive spending. Finding a balance between your needs and wants is crucial for a sustainable financial plan.

Identifying and Managing Triggers

Identifying the triggers behind your impulse purchases is a critical step in avoiding them. Are you more likely to make impulse purchases when you're feeling stressed, bored, or lonely? Understanding these triggers allows you to develop strategies to manage them effectively. By recognizing the root causes, you can develop coping mechanisms and reduce the likelihood of impulsive decisions.

Setting Realistic Financial Goals

Setting realistic financial goals gives you a clear direction and purpose in your spending. Whether it's saving for a down payment on a house, paying off debt, or simply building an emergency fund, having specific goals helps you stay focused on your long-term financial objectives. This focus helps you resist the temptation of immediate gratification and encourages more thoughtful spending decisions.

The Power of Delayed Gratification

Delayed gratification is a powerful tool in managing impulse purchases. Learning to resist the urge for immediate satisfaction and instead wait for a more opportune time is a skill that can save you money and reduce financial stress. Developing self-control and patience is key to curbing impulsive spending habits. Understanding the long-term implications of impulsive purchases will contribute to overall financial well-being.

Progressive overload is a fundamental principle in strength training, meaning gradually increasing the demands placed on your muscles over time. This gradual increase in stress is crucial for stimulating muscle growth and strength gains. Without progressively increasing the load, your body adapts to the existing workload, and further progress stalls. This concept applies to various aspects of training, from lifting weights to bodyweight exercises and even cardio.

Debt Management: Avoiding Financial Pitfalls

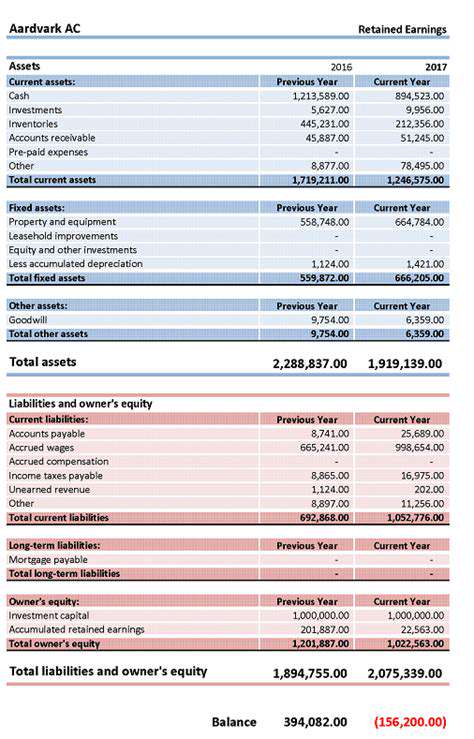

Understanding Debt

Debt, while a common aspect of modern financial life, can quickly spiral out of control if not managed responsibly. Understanding the various types of debt, such as credit card debt, student loans, and mortgages, is crucial. Each type carries its own interest rates and repayment schedules, impacting the overall financial burden.

A clear understanding of your current debt situation is the first step toward effective management. This involves meticulously documenting all outstanding debts, including the principal balance, interest rate, and minimum payment due. This detailed record provides a baseline for developing a comprehensive debt reduction strategy.

Budgeting for Debt

Creating a realistic budget is essential for effectively managing your debt. This process involves meticulously tracking income and expenses, identifying areas where spending can be reduced, and allocating a portion of your income specifically to debt repayment.

Prioritizing debt repayment based on interest rates is often a strategic approach. High-interest debt should be tackled first to minimize the overall cost of borrowing. This proactive approach can save you significant money over time.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a potentially lower interest rate. This can simplify repayment and potentially reduce overall interest payments.

However, it's crucial to carefully evaluate the terms of any consolidation loan, including the interest rate and fees. A poor choice could lead to increased financial strain rather than relief.

Debt Negotiation

In certain situations, negotiating with creditors to lower interest rates or monthly payments can be a viable option. This strategy might be particularly helpful for individuals facing significant financial hardship.

Seeking Professional Guidance

Financial advisors and credit counselors possess expertise in debt management strategies. They can provide valuable insights and personalized guidance based on your individual circumstances.

Seeking professional advice can empower you with a clear roadmap for managing your debt effectively. They can also help you avoid common pitfalls and make informed decisions about your financial future.

Debt Management Plans

Debt management plans (DMPs) are structured repayment plans designed to help individuals consolidate their debts and manage their finances more effectively. These plans often involve negotiating with creditors to lower interest rates and reduce monthly payments.

These plans can provide a structured approach to debt reduction, potentially relieving financial stress and restoring stability. However, it's essential to understand the terms and conditions of the DMP before committing.

Avoiding Debt Traps

Avoiding impulsive purchases and maintaining a healthy spending habit are essential steps in preventing debt accumulation. Understanding your financial limits and avoiding excessive borrowing is vital.

Developing sound financial habits early on can significantly reduce the risk of falling into debt traps. Building an emergency fund and practicing responsible budgeting are crucial components of long-term financial well-being.

Read more about Practical Money Management for Young Minds

Hot Recommendations

- Practical Tips for Enhancing Kids’ Resilience

- How to Balance Education and Companionship for Kids with ADHD

- Practical Money Management for Young Minds

- Best Study Schedule Tips for Busy Students

- Top Tips for Raising Financially Savvy Children

- Practical Special Needs Education Techniques 2025

- Top Study Habits for Academic Success

- Comparing Parenting Styles: Strict vs Balanced

- Best Study Habit Techniques for Students 2025

- Practical Advice for Special Needs Family Support