How to Prepare Your Child for Life with Financial and Emotional Skills

Understanding Personal Finance Basics

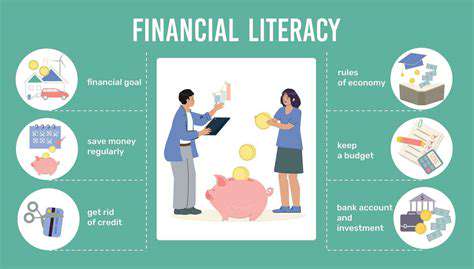

Building a solid financial base is absolutely vital for reaching long-term financial objectives, whether it's saving for a home purchase or preparing for retirement. Grasping core concepts like budgeting, saving, and investing forms the bedrock of sound financial decision-making. These competencies aren't merely about growing wealth—they're about cultivating an empowered, intentional relationship with your finances. When you master these fundamentals, you gain the ability to make choices that truly reflect your values, ultimately leading to enhanced financial stability and peace of mind.

Many individuals find personal finance challenging simply because they never learned the basic principles. The journey to financial health begins with clearly seeing where your money flows and learning to direct it purposefully. This fundamental process involves monitoring income and expenditures, crafting a practical budget, and becoming familiar with various financial instruments available in the market.

Establishing a Realistic Budget

A budget isn't just a financial spreadsheet—it's a living document that guides your monetary choices. When you construct a thoughtful budget, you create a clear picture of your financial landscape, revealing opportunities to save and helping you make more conscious spending decisions. Through detailed tracking of income and outgoings, you uncover valuable patterns in your financial behavior, highlighting areas where you might be spending excessively or not setting aside enough for future needs. Effective budgets account for both fixed obligations and variable costs, maintaining flexibility for life's inevitable changes.

Think of your budget as a financial compass rather than a set of handcuffs—it should adapt as your circumstances evolve. This dynamic tool helps you balance essential expenses with meaningful savings and investment goals. By regularly reviewing and adjusting your budget, you ensure it continues serving as an accurate roadmap for your financial journey.

Saving for the Future: The Importance of Emergency Funds

Creating an emergency reserve represents one of the most prudent financial moves you can make. This accessible pool of funds acts as your financial first-aid kit, ready to handle unexpected blows like job transitions, medical crises, or urgent home repairs. An emergency fund serves as your financial shock absorber, preventing you from relying on high-cost debt when life throws curveballs. Establishing this safety net marks a critical milestone in achieving true financial resilience.

The ideal size of your emergency cushion varies based on your personal situation, but financial experts commonly recommend accumulating enough to cover three to six months of essential living expenses. This substantial buffer helps you navigate unforeseen challenges while maintaining your standard of living without depleting other savings meant for different purposes.

Developing Smart Investment Strategies

While investment strategies might appear intimidating at first glance, they become more approachable when broken down. Familiarizing yourself with various investment vehicles—from traditional stocks and bonds to mutual funds and property investments—can transform how you approach wealth building. The earlier you implement thoughtful investment approaches, the more you benefit from the magic of compounding over decades. Taking time to research and understand different investment avenues leads to more confident, informed choices.

A key principle in successful investing involves diversifying your portfolio across different asset categories. This strategy helps balance potential risks while optimizing returns. By distributing your investments among various asset types, you create a more resilient financial portfolio. Gaining familiarity with the broad spectrum of investment possibilities equips you to make decisions that best support your unique financial aspirations and comfort levels.

Read more about How to Prepare Your Child for Life with Financial and Emotional Skills

Hot Recommendations

- Best Education Techniques for Children with Autism

- Supporting Special Needs Kids: Strategies for Education and Companionship

- How Can I Improve Early Childhood Learning at Home?

- How to Navigate Different Parenting Styles Together

- How to Create Consistency with Positive Discipline Techniques

- Step by Step Guide to Positive Behavior Management

- Tips for Encouraging Social Skills in Children with Autism

- How to Support Special Needs Children at Home

- How to Balance Financial, Emotional, and Adversity Skills

- How to Encourage Good Behavior Through Positive Reinforcement