How to Combine Financial and Emotional Education

The Intertwined Nature of Finance and Feelings

Understanding the Fundamentals

Finance, at its core, is about the management of money and resources. This encompasses a wide spectrum of activities, from personal budgeting to complex international investments. Understanding the fundamental principles of finance is crucial for anyone seeking to navigate the world of money effectively, whether it's managing personal finances or participating in the global economy.

Key concepts like risk, return, and opportunity cost are essential to grasp. These principles are not just theoretical; they actively shape financial decisions and outcomes. Understanding these concepts helps individuals and organizations make informed choices about how to allocate resources and achieve their financial objectives.

Investment Strategies

Investment strategies are diverse, ranging from simple savings accounts to complex hedge funds. Each strategy carries its own set of risks and rewards, and a careful analysis of these factors is paramount for success.

Diversification is a cornerstone of many successful investment strategies. By spreading investments across various assets, investors can potentially mitigate risk and maximize returns. Understanding different asset classes, such as stocks, bonds, and real estate, is crucial for developing a well-rounded investment portfolio.

Financial Markets and Institutions

Financial markets are dynamic platforms where buyers and sellers exchange financial instruments. These markets provide vital liquidity and facilitate the allocation of capital, which is critical for economic growth.

The Role of Government Regulation

Governments play a vital role in shaping the financial landscape through various regulations. These regulations are designed to protect investors, maintain market stability, and prevent financial crises. Understanding how government regulations impact financial markets is essential for navigating the complexities of the financial world.

International Finance

International finance involves the flow of capital across national borders. This includes international trade, foreign direct investment, and global financial markets. The interaction of different currencies, economies, and regulations is intricate and requires a nuanced understanding.

Global interconnectedness is a key feature of international finance. Events in one country can have significant ripple effects on the global financial system. This underscores the importance of international cooperation and coordination in managing financial risks.

Personal Finance Management

Personal finance management encompasses the strategies individuals use to manage their personal finances. This includes budgeting, saving, investing, and debt management. Understanding these principles can help individuals achieve their financial goals, such as homeownership, retirement, or other important milestones.

Ethical Considerations in Finance

Ethical considerations are increasingly important in the financial world. Maintaining transparency, fairness, and accountability is crucial for building trust and fostering a stable financial system. Ethical dilemmas in finance require careful consideration and a commitment to responsible practices. This includes issues like conflict of interest, insider trading, and the impact of financial decisions on society and the environment.

Identifying Your Emotional Triggers

Understanding Your Emotional Landscape

Identifying your emotional triggers is a crucial first step in managing your financial well-being. Understanding how your emotions influence your financial decisions is essential to creating a more balanced and sustainable approach to money management. This involves recognizing the subtle and not-so-subtle ways in which feelings like fear, anxiety, greed, or excitement can impact your spending habits, investment choices, and overall financial strategy. By acknowledging these emotional patterns, you can begin to develop strategies for mitigating their negative effects and making more rational financial decisions.

This self-awareness extends beyond simply recognizing the triggers themselves. It also involves exploring the root causes of those emotions. Are they stemming from past experiences? Are they tied to societal pressures or expectations? Uncovering these underlying factors is key to developing effective coping mechanisms and building a more resilient financial mindset.

The Impact of Emotions on Financial Decisions

Emotional responses often lead to impulsive financial decisions that can have long-term consequences. For instance, fear of missing out (FOMO) can drive you to invest in high-risk ventures or make large purchases you can't afford, potentially leading to significant financial strain. Likewise, anxieties about the future can cause you to hoard money, limiting your investment opportunities and hindering your financial growth. Understanding these connections is critical for building a robust financial strategy that prioritizes rational decision-making over emotional impulses.

Recognizing Common Emotional Triggers

Several common emotional triggers can significantly influence your financial decisions. For example, feelings of inadequacy or insecurity can lead to a desire to impress others through lavish spending. Conversely, past financial hardship might trigger anxieties about future setbacks, leading to excessively cautious and potentially limiting financial choices. Recognizing these typical emotional patterns is an important aspect of understanding your own financial behavior.

Another common trigger is the fear of losing money. This can manifest as reluctance to invest, or conversely, as a tendency to take on excessive risk in an attempt to recoup losses. Understanding the specific triggers that affect you personally is key to developing effective strategies for managing these emotions.

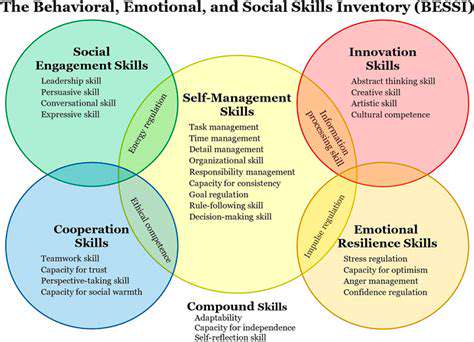

Developing Emotional Intelligence for Financial Success

Cultivating emotional intelligence is a crucial component of financial success. This involves developing the ability to recognize, understand, and manage your emotions, as well as empathize with the emotions of others. By developing this skill, you can make more informed financial decisions by reducing the influence of emotional responses.

This includes practicing mindfulness and stress management techniques to help you stay grounded during periods of financial uncertainty. Seeking support from a financial advisor or therapist can also be invaluable in navigating complex financial situations and managing associated emotional responses.

Connecting Emotional and Financial Goals

Integrating emotional awareness into your financial planning is essential for achieving both financial and emotional well-being. Consider how your emotional responses align with your financial goals. Are your spending habits aligned with your long-term financial objectives? Understanding these connections can help you create a more cohesive and fulfilling financial plan. By connecting your emotional needs with your financial goals, you can create a more sustainable and satisfying financial roadmap.

Identifying emotional triggers can also help you understand how your feelings impact your spending habits and overall financial strategy. This insight can empower you to make more intentional choices, setting the stage for achieving long-term financial success while maintaining emotional equilibrium.

Developing Emotional Regulation Strategies

Understanding Emotional Triggers

Identifying the specific situations, events, or thoughts that trigger strong emotional responses is crucial for developing effective regulation strategies. This process involves introspection and self-awareness, examining patterns in your emotional reactions. Recognizing these triggers allows you to anticipate potential emotional outbursts and prepare coping mechanisms. For example, if a particular financial discussion with your partner consistently leads to arguments, understanding this trigger will allow you to proactively address the underlying issues and manage your emotional response more effectively.

Furthermore, understanding your personal emotional landscape can help you anticipate how certain financial news or market fluctuations might affect your mood. Recognizing these potential triggers beforehand empowers you to choose strategies for managing your emotional state, rather than reacting impulsively to negative financial events.

Developing Coping Mechanisms

Once you've identified your emotional triggers, you need to develop effective coping mechanisms. These can range from simple techniques like deep breathing exercises to more complex strategies like mindfulness meditation or engaging in activities that provide emotional relief. The key is finding methods that work for you and incorporating them into your daily routine. For instance, scheduling time for relaxation or engaging in hobbies can be powerful tools in managing stress associated with financial anxieties.

Practicing Mindfulness and Self-Compassion

Mindfulness involves paying attention to the present moment without judgment. Practicing mindfulness can help you observe your emotions without getting swept away by them. When facing financial challenges, mindfulness can provide a crucial space for managing your emotional reaction to stress and uncertainty. It allows you to acknowledge the feeling without letting it overwhelm you, making it easier to find solutions to your financial problems.

Self-compassion is another crucial aspect of emotional regulation. It involves treating yourself with kindness and understanding, especially during challenging times. Remember, making mistakes or experiencing setbacks is a normal part of life, and financial struggles are no exception. Practicing self-compassion helps you navigate difficult situations with greater resilience and reduces the likelihood of emotional distress.

Integrating Emotional Regulation into Financial Decisions

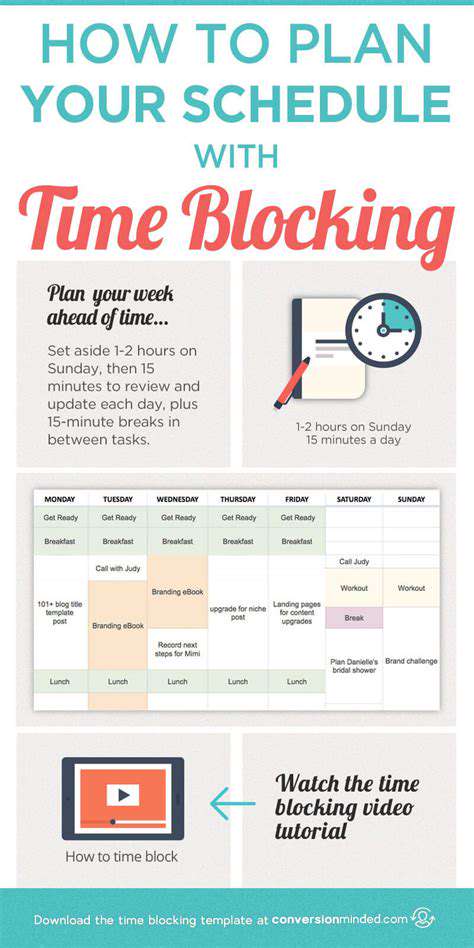

Emotional regulation is not just about managing your feelings; it's also about integrating these skills into your financial decision-making process. When emotions run high, it's easy to make impulsive decisions that could negatively impact your long-term financial well-being. By developing emotional regulation strategies, you can make more thoughtful and rational financial choices, even during times of stress or uncertainty. This includes things like avoiding impulsive spending or investing decisions driven by fear or greed.

Developing a plan for managing finances, incorporating regular review sessions, and creating a budget that accounts for potential emotional responses to financial situations are key steps in achieving financial stability and emotional well-being.

Read more about How to Combine Financial and Emotional Education

Hot Recommendations

- Efficient Study Habits for Middle Schoolers

- How to Foster Cooperation Between Co Parents

- Best Education Techniques for Children with Autism

- Supporting Special Needs Kids: Strategies for Education and Companionship

- How Can I Improve Early Childhood Learning at Home?

- How to Navigate Different Parenting Styles Together

- How to Create Consistency with Positive Discipline Techniques

- Step by Step Guide to Positive Behavior Management

- Tips for Encouraging Social Skills in Children with Autism

- How to Support Special Needs Children at Home