Creative Financial Education Tips for Kids

Turning Chores into Cash: A Simple Strategy

Many people overlook the potential for Turning everyday chores into extra income. This approach, often overlooked in traditional financial education, can be a powerful tool for building savings, paying off debt, or achieving financial goals. By assigning a monetary value to tasks normally performed for free, you're essentially recognizing the value of your time and effort. This mindset shift can empower you to view everyday activities with a new perspective, transforming mundane chores into opportunities for financial growth.

Consider the time you spend cleaning, organizing, or running errands. These tasks, while seemingly insignificant, often take up a considerable portion of your day. By monetizing these activities, you're effectively capitalizing on these existing time commitments and transforming them into tangible financial rewards. This simple concept can be a game-changer in your financial journey.

Setting Realistic Prices for Your Services

Establishing fair and competitive prices for your services is crucial. Research similar services in your area to understand market rates. Factor in your experience level, the time commitment involved, and the value you bring to clients. Don't undervalue your skills; pricing your services competitively will attract clients and demonstrate your professionalism.

Be transparent about your rates. Clearly communicate your pricing structure to potential clients. A detailed breakdown of your charges will foster trust and ensure mutual understanding. This transparency can lead to more successful transactions and build a strong foundation for future collaborations.

Finding Clients and Building a Network

Building a network of potential clients is essential for turning chores into cash. Leverage your existing social circles, family connections, and online platforms to reach a wider audience. Post about your services on social media, create a simple website, or consider using online freelancing platforms. Networking and reaching out to people you know can significantly increase your clientele base.

Managing Invoicing and Payments

Efficient invoicing and payment processing are vital for maintaining a smooth workflow. Use simple invoicing software to generate professional invoices, and ensure timely payments from clients. Establish clear payment terms and procedures to avoid any misunderstandings. This systematic approach will help you track your income effectively and maintain accountability.

Tracking Your Income and Expenses

Keeping meticulous records of your income and expenses is crucial for understanding your financial progress. Use a spreadsheet, accounting software, or a simple notebook to document your earnings. Categorize your income sources to understand where your money is coming from and where it's going. This detailed record-keeping will help you identify patterns, understand your spending habits, and make informed financial decisions.

Legal Considerations and Compliance

While turning chores into cash may seem simple, it's important to understand the legal implications. Ensure you're compliant with any local regulations or licensing requirements. Familiarize yourself with tax implications for your earnings. Consult with a financial advisor or accountant to understand the specific requirements based on your location and the nature of your services. This proactive approach ensures you're operating within the legal framework and avoid potential issues down the line.

Alabama's offensive prowess is a significant factor in their success against Florida. They consistently demonstrate a high-powered attack, relying on a combination of a strong running game and a capable passing game. Their offensive line is typically well-protected, allowing the quarterback ample time to survey the field and make accurate throws. This consistent offensive production has been a hallmark of their success throughout the rivalry.

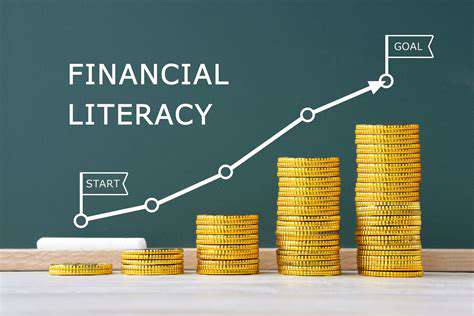

Financial Literacy Through Everyday Experiences: Learning from Real-Life Scenarios

Understanding Budgeting Fundamentals

Budgeting is a cornerstone of financial literacy, enabling individuals to track their income and expenses. A well-structured budget allows for a clear understanding of where money is going and helps identify areas for potential savings. By meticulously recording all income and expenses, individuals gain valuable insight into their spending habits and can make informed decisions about their financial future. Effective budgeting is crucial for achieving financial stability and reducing debt.

Beyond simply tracking, budgeting helps prioritize needs and wants. Understanding the difference between essential expenses and discretionary spending is key to making conscious financial choices. This process empowers individuals to allocate resources effectively and avoid impulsive purchases that can derail financial goals.

Managing Debt Effectively

Debt management is a critical aspect of financial literacy, encompassing various strategies for handling outstanding loans and credit card balances. Understanding different types of debt, such as mortgages, student loans, and personal loans, is essential for developing a comprehensive debt reduction plan. This involves analyzing interest rates, repayment terms, and potential penalties associated with each form of debt.

Effective debt management often involves prioritizing high-interest debts for repayment. This approach can significantly reduce the overall cost of borrowing over time. This is a crucial step in achieving financial freedom and improving credit scores.

Investing for the Future

Investing plays a vital role in building wealth and securing financial independence for the future. Understanding different investment options, such as stocks, bonds, and mutual funds, is crucial for making informed investment decisions. Researching and selecting appropriate investment strategies aligned with individual risk tolerance and financial goals is paramount. Thorough research is essential for making sound investment choices and maximizing returns.

Diversification is a key principle in investment strategies. Diversifying investments across various asset classes can help mitigate risk and potentially enhance overall returns. Understanding diversification strategies is essential for long-term financial success and reducing the impact of market fluctuations.

Saving and Planning for Goals

Saving is a fundamental aspect of financial literacy, enabling individuals to achieve their short-term and long-term financial goals. Developing a savings plan that aligns with individual circumstances and aspirations is vital for securing a stable financial future. This involves establishing realistic savings targets and creating a consistent savings routine. Consistent savings are the foundation of achieving financial security.

Long-term financial planning, such as retirement planning and education funding, often requires significant savings. Understanding different savings vehicles, such as individual retirement accounts (IRAs) and 529 plans, can help maximize savings and minimize taxes. Thorough planning for future goals is crucial for ensuring a comfortable and secure financial future.

Read more about Creative Financial Education Tips for Kids

Hot Recommendations

- Efficient Study Habits for Middle Schoolers

- How to Foster Cooperation Between Co Parents

- Best Education Techniques for Children with Autism

- Supporting Special Needs Kids: Strategies for Education and Companionship

- How Can I Improve Early Childhood Learning at Home?

- How to Navigate Different Parenting Styles Together

- How to Create Consistency with Positive Discipline Techniques

- Step by Step Guide to Positive Behavior Management

- Tips for Encouraging Social Skills in Children with Autism

- How to Support Special Needs Children at Home